Briefing

Briefing

Updated 2025 Benefit Limits for Health & Welfare Plans

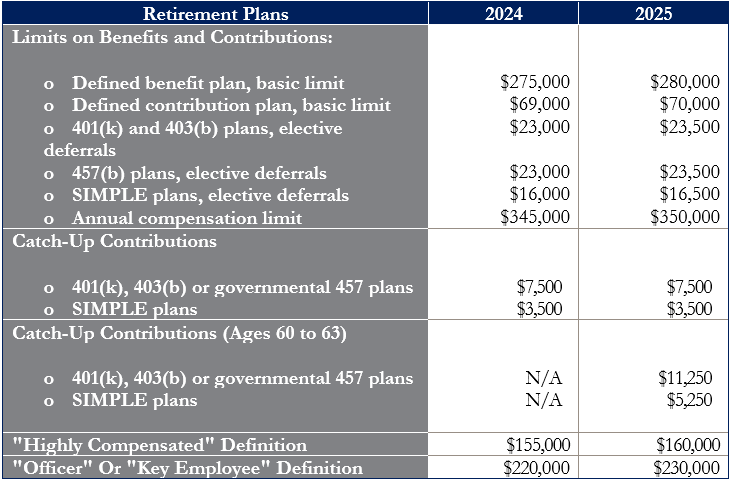

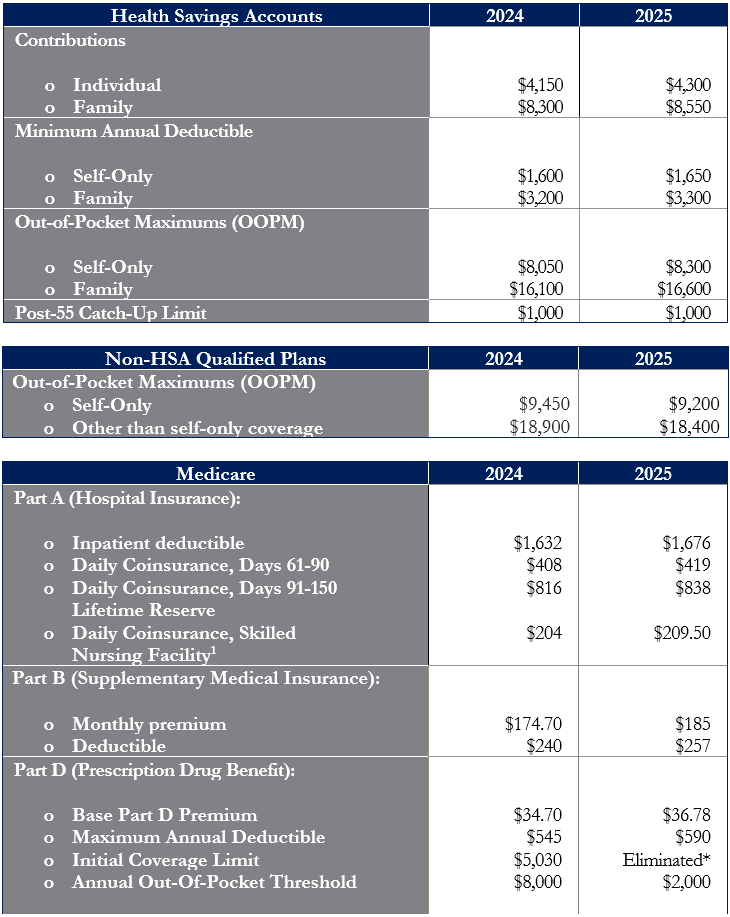

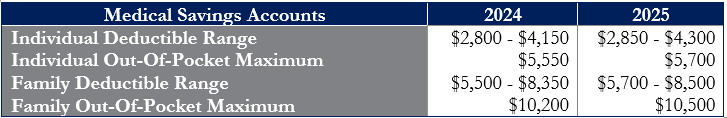

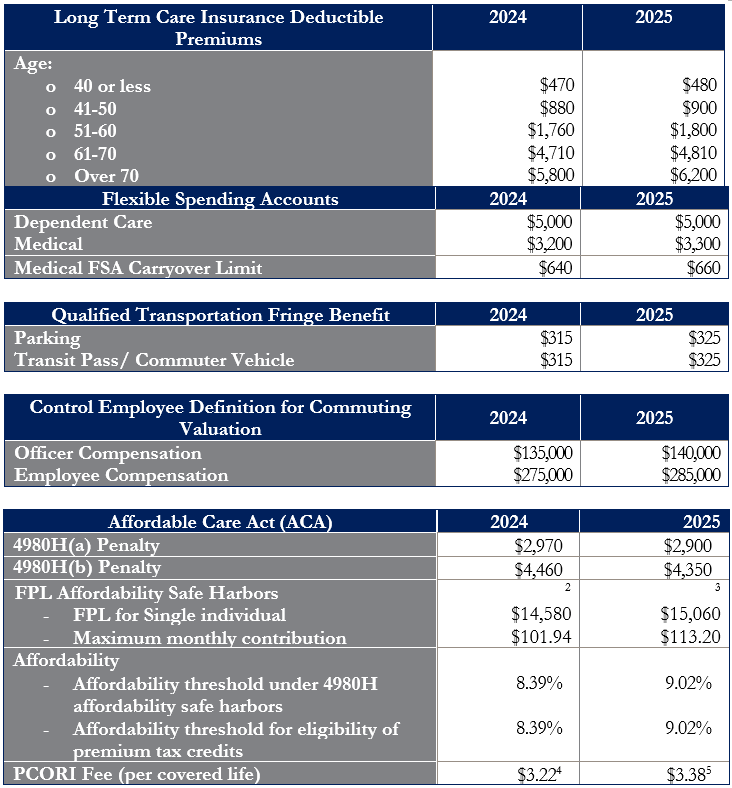

Every year, the U.S. Government sets new limits for various benefit programs to reflect inflation and changes in the law. Following are the limits announced for 2025. Employers should review their benefit plans to ensure they reflect these new limits. Please note that the Initial Coverage Limit for Medicare Part D has been eliminated in 2025. Also, please note that the Catch-Up Contribution limits for defined contribution plans have increased for ages 60 to 63.

Please contact your Keenan Account Manager for questions regarding this briefing.

[1] For days 21-100. Days 1-20 is $0 for each benefit period.

[2] Use 2024 poverty guidelines to determine affordability.

[3] Use 2025 poverty guidelines to determine affordability.

[4] For plan years ending on or after October 1, 2023 and before October 1, 2024.

[5] Projected - For plan years ending on or after October 1, 2024 and before October 1, 2025.

Keenan is not a law firm and no opinion, suggestion, or recommendation of the firm or its employees shall constitute legal advice. Clients are advised to consult with their own attorney for a determination of their legal rights, responsibilities, and liabilities, including the interpretation of any statute or regulation, or its application to the clients’ business activities.

Subscribe

Subscribe to the Keenan Blog